Unique Sagentia research: Consumers and their views and attitudes around the personal care and beauty sector

This is one of a series of pieces based on research conducted by Sagentia earlier this year and introduces us to some of the key themes and results on consumers’ choices and use of personal care and beauty products. The research was conducted with focus groups and through online research.

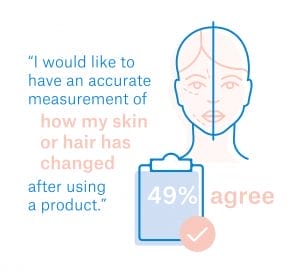

How do consumers tell whether their cosmetics products are working?

These stats from the online research was reflected across all our consumer focus groups, the judge of whether a product was working or not was the individual themselves; how the product felt on the skin, if they felt good when using it, or saw for themselves their skin looked improved. For our older female group it was about “feeling fabulous” and not just about what the product did (such as reducing fine lines). One consumer sums this up stating: “I think it’s just about how we feel, it’s not necessarily how it’s reflected back on us (by others) or measured (by a device)”.

All our consumers understood and viewed skin care is being more than just about products. While some wished for a ‘miracle product’ the reality was that diet, lifestyle and genetics, were all factors contributing to a general and aspirational goal of wellbeing and looking and feeling great.

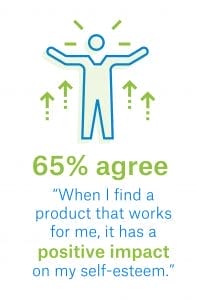

The majority of women across both our groups tended to use several different products in their daily routine (cleanser, serum, eye cream, and moisturiser). They were less brand loyal, and instead wanted to find a product that “just worked”; this was seen as a real challenge and predominantly achieved through trial and error and often resulting in a lot of waste - if a product wasn’t liked, it wasn’t used - and a lot of frustration.

To address this, many of our groups liked getting samples as allowed them to try lots of different products and brands without the upfront investment and perceived ‘risk’ associated with trying something new and not liking it.

A new way of shopping:

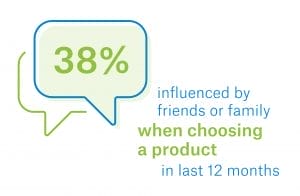

In our focus groups too, the majority of consumers across all our groups looked for and relied on the recommendations of friends and family as well as reading reviews, doing their own research (especially for specific problems or sensitivities), trusting influencers, independent awards, reading editorial and other advice such as from a salon professional. These insights were trusted much more than brand advertising as it was seen as being ‘tried and tested’ and therefore more likely to be appropriate for them.

There was also recognition that they’ve changed the way they shop with many purchasing products online as well as visiting physical stores.

The increase of niche brands was really welcomed as it provided more choice, not only of a range of products but that could be more personalised to their needs or values such as ingredients, ethical or natural.

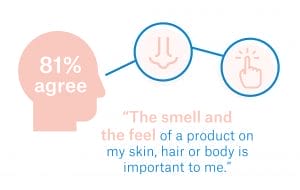

The fundamentals that are core to it all remain price (value for money), smell, feel when using, and packaging; these factors were consistently deemed as being most important when choosing a product and can trump brand – although, for some consumers, this was still a deciding factor as it was linked with trust.

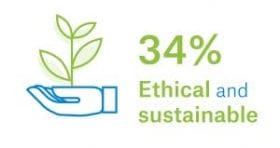

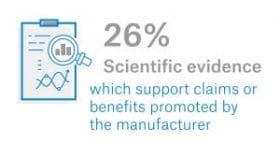

This was reflected in our online survey where we asked: “what’s important to you when purchasing personal care products?”

Where is the future taking us for personal care and beauty products?

In our focus groups, personalisation was seen by nearly all our consumers as something to aspire to and would drive interest and engagement with products. The majority of women expressed a desire for a more personalised product but were sceptical of the cost for something that was genuinely bespoke to them.

Products and devices, mirrors and measurement were of interest to some but within the experience of a spa day, a salon visit and as a one-off; there was little interest in something that was ongoing or for use in the home. However much of this was driven by a nervousness of “making sure I was using the device properly and not damaging my skin”, ease of use and cost.

Where these combined and there was genuine interest was for a personalised analysis and then a subscription box of tailored – and brand agnostic - skin care products. This element of personalisation was seen as helping to remove some of the choice and making a wrong decision and therefore increasing the confidence of knowing that what you chose was right for you and would ‘work’ – this was important and where the value was attributed.

For more information on this research and our experience and expertise in helping some of the world’s most recognised cosmetics and beauty brands transform their innovations into reality, contact us at: [email protected] or visit www.sagentiainnovation.com/market/personal-care/.

YouGov Research

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 2029 GB adults. Fieldwork was undertaken between 9th-10th September 2019. The survey was carried out online. The figures have been weighted and are representative of all GB adults (aged 18+).

Information on our focus groups

The focus groups took place at Leatherhead Food Research offices in Epsom on 9th and 10th April 2019

Focus groups consisted of at least 12 participants

Group 1: females aged 18–39 – self-defined as medium users of cosmetics and beauty products

Group 2: females aged 40+ - self-defined as heavy users of cosmetics and beauty products

Group 3: males aged 18–39 – self-defined heavy users of cosmetics and beauty products