How R&D can tackle the energy trilemma of security, sustainability, and affordability in 2024

By Michele Turitto - Managing Partner, Industrial, Chemicals & Energy and Shreekant Mehta - SVP, Energy

Almost every country signed the global renewables and energy efficiency pledge at COP28. It includes a commitment to triple the world’s installed renewable energy generation capacity by 2030 as part of the transition away from fossil fuels. In this context, government incentives will likely sustain the momentum of renewable energy. Nevertheless, investment decisions should be informed by solid scientific analyses, so priority is given to opportunities that are viable regardless of subsidisation.

Though renewables are increasingly prominent in the energy mix, hydrocarbons cannot be replaced until alternatives provide like-for-like energy content, ROI, and overall efficiency. This poses an energy trilemma: sector players must concurrently assess risks and opportunities associated with security, sustainability, and affordability.

On this basis, there is a strong need to maximise the value of technology development and innovation, balancing deep technical expertise with commercial pragmatism. Experts from Sagentia Innovation’s Industrial, Chemicals, and Energy division say this will have a profound impact on R&D programmes for oil and gas companies that strive to extract the most value from aging assets and alternative energy development over the next 12 months.

Aging oil and gas assets

Digital technologies continue to transform the management of aging oil and gas assets. Whether the aim is to improve productivity or lay them to rest in a safe, economical, and sustainable manner, digitalisation brings new capabilities.

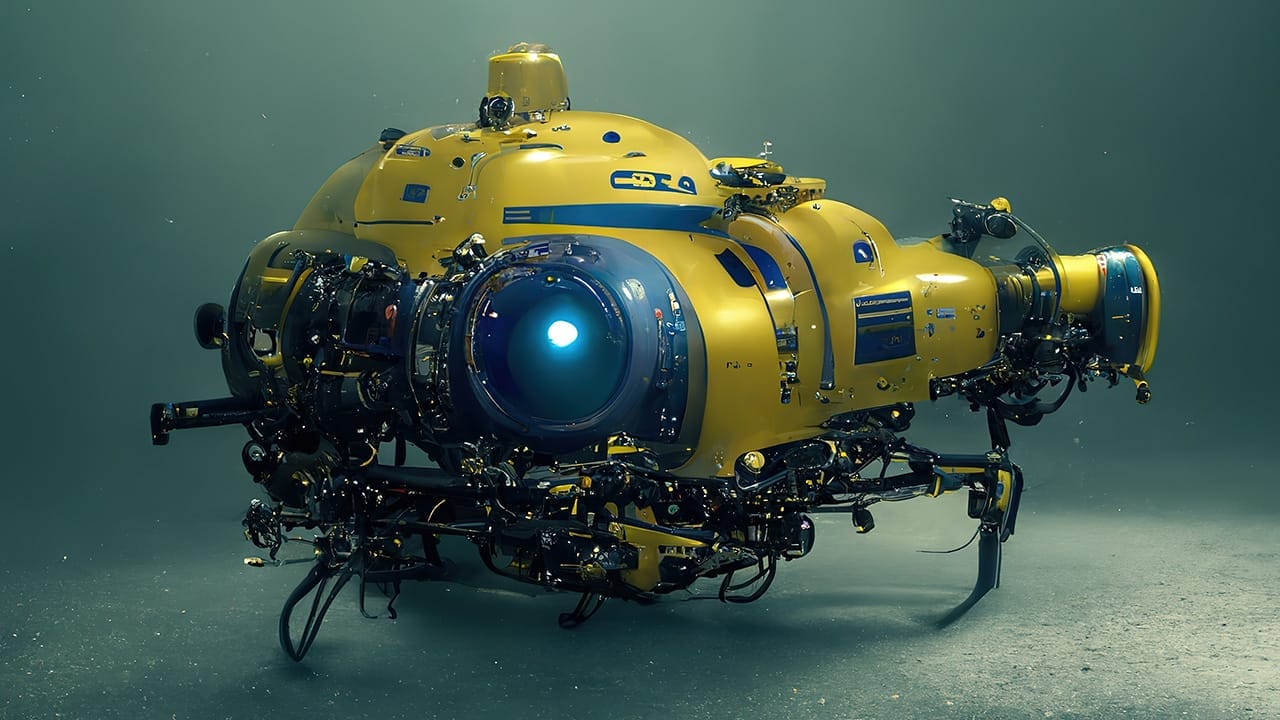

One area of innovation is the drive towards resident autonomous underwater vehicle (AUV) systems. Significant progress has been made over the past five years, with Equinor’s deployments of the SONSUB Hydrone system (2019), the Saab Seaeye underwater robot which remains docked on the seabed between tasks (2022), and the Oceaneering LibertyTM resident system for remote subsea isolation (2023).

The capabilities of AUV deployments are expected to extend in 2024. For instance, Subsea Wireless Group (SWiG) - an industry forum facilitated by Sagentia Innovation - focuses on standards for subsea communications, allowing different technology types or equipment from different vendors to communicate (e.g. switching between acoustic and optical communications, or vendor A acoustically communicating with vendor B). Modern communications technology has much to offer aging infrastructure, increasing efficiency and maintaining safe operations to delay retirement. Communications standards which allow interoperability are an important aspect of this, and a central focus of the SWiG network.

At a wider level, robotic technologies will be augmented by artificial intelligence (AI) and machine learning. This will manifest in the development of approaches such as swarm robotics, where suites of drones or AUVs use ‘group think’ to co-ordinate and facilitate more sophisticated remote inspection and management of facilities.

Further maturation of sensor technology and Internet of Things capabilities is on the cards too. It’s partly about enhancing intelligence with rugged, accurate sensors that perform reliably in harsh environments. However, additional monitoring exacerbates the challenge of handling vast quantities of data. So, finding the right balance between processing on the edge at a sensor level versus transferring large volumes of data to the cloud requires careful consideration.

Alternative energy developments

Uncertainty surrounding the route to energy transition makes it hard to plot the best course for technical developments in alternative energy. Clearly, wind and solar will play a key role in future energy provision given the technology maturity achieved to date. From a commercial standpoint, these sources are increasingly cost competitive; it is already cheaper to build new renewable plants than to operate existing coal plants1.

Nevertheless, offshore wind struggled in 2023. Supply chain bottlenecks, increased costs, and issues with contract pricing compromised projects’ profitability. Additional emergent issues include the inspection and maintenance of floating wind turbines or farms, mooring in challenging environments, and wind blade recycling2.

Uptake of wind and solar also needs to be supported by advancements in storage solutions. Challenges surrounding infrastructures and mineral supply chains for batteries (sodium batteries being explored as a more accessible alternative to lithium) remain unresolved. So, the million-dollar question is which other alternative sources can be harnessed efficiently and effectively to fill the gaps?

We anticipate a growing focus on biofuels, geothermal, and carbon capture, utilisation and storage (CCUS). While CCUS is seen by its detractors as maintaining a hydrocarbon-focused energy system, pragmatists understand that it will facilitate energy transition. We explore this topic in more detail in a dedicated article (CCUS opportunities and technical challenges).

Developments related to hydrogen also hold potential, but this remains embryonic at present. Despite the hype and hopes of many, technical feasibility and commercial viability require significant development. Hydrogen’s apparent adaptability as an energy vector has seen it associated with uses that, though theoretically feasible, are non-starters when assessed against strong science-centred analysis. Recent news of government and commercial U-turns on hydrogen projects 3,4 are a stark reminder of the need for solid technical and commercial due diligence.

Smart investment is likely to prioritise use of hydrogen near the point of generation rather than applications requiring transportation. Sensible advancements will centre on the conversion of existing fossil fuel based hydrogen generation to green methods, e.g. for fertiliser production or oil refining.

Rigorous ROI-led innovation

As the energy sector continues to navigate the trilemma of security, sustainability, and affordability in 2024, we expect R&D decision-making to be influenced by three key factors:

- The evolution of oil and gas companies into energy companies – balancing legacy and emerging business models.

- Doing more with less – considering where resources are allocated and how they are leveraged.

- Sustainability being a key parameter against which companies’ and execs’ performance is assessed.

Finding the sweet spot between ambition and pragmatism will be critical to success. At Sagentia Innovation we have an established model to optimise technology portfolio decisions in this vein, balancing market leadership aspirations with ‘fast follower’ or ‘smart adopter’ approaches.

Applying a market-focused approach to technology innovation delivers a quicker, more streamlined process and better commercial returns. Contact us today if you’d like to discuss how we can enhance your innovation strategy or to learn more about our OTM Networks and enjoy a complimentary session - www.sagentiainnovation.com/contact-us/

References:

1 New US Solar and Wind Cost Less Than Keeping Coal Power Running - Bloomberg [https://www.bloomberg.com/news/articles/2023-01-30/new-us-solar-and-wind-cost-less-than-keeping-coal-power-running?leadSource=uverify%20wall

2 Wind blade recycling, a new challenge for global energy - Iberdrola - Iberdrola [https://www.iberdrola.com/sustainability/wind-blade-recycling]

3 UK cancels controversial hydrogen heating trial in Redcar due to ‘lack of H2 supply’ | Hydrogen news and intelligence (hydrogeninsight.com) [https://www.hydrogeninsight.com/policy/uk-cancels-controversial-hydrogen-heating-trial-in-redcar-due-to-lack-of-h2-supply-/2-1-1571341]

4 Orsted Walks Away From Green Hydrogen Project Citing High Costs - Bloomberg [https://www.bloomberg.com/news/articles/2023-11-21/german-oil-refinery-shelves-hydrogen-project-citing-high-costs?leadSource=uverify%20wall