Home hygiene: navigating natural ingredients

Authors: Cesar Vargas-Razo, Principal Consultant – Consumer, and Elizabeth Clark, Consultant Chemist

As competition heats up in the green cleaning space, use of natural ingredients is increasing. However, ‘natural’ can be an ambiguous term and claims about products containing these materials sometimes lack clarity. Cesar Vargas-Razo, Principal Consultant – Consumer, and Elizabeth Clark, Consultant Chemist, advocate transparency to earn consumer trust and ensure regulatory compliance. Here, they consider how to define and label natural ingredients in the home hygiene category.

Recent figures suggest that the global market for green household cleaning products is set to grow from USD 298.90 billion in 2023 to USD 494.96 billion by 2030 (Research and Markets). As Consumer Packaged Goods (CPG) companies contend for this space, use of natural ingredients is on the rise. There’s a widespread notion that products containing them are better for consumers and better for the environment.

However, when it comes to formulated products, natural is hard to define. Ingredients don’t always fit into neat categories; there’s a spectrum running from natural extracts to materials that are naturally derived, nature-identical, biosynthetic, and synthetic. To complicate matters further, regulator opinion on what constitutes a natural ingredient varies around the world too.

Meanwhile, consumers and regulators are placing more scrutiny on natural claims. Evolving regulatory measures to mitigate greenwashing in the UK and EU specifically mention natural claims, and the ‘truthful and non-misleading’ principle also applies. So, what’s the best way forward?

Defining ‘natural’ for the home hygiene category

Most people define a natural material as one that occurs in nature. Plant sources are considered natural, as are plant oil extracts. On this basis, petroleum might be considered natural too, as crude oil is derived from the slow decomposition of plants and animals over millennia, but few would classify it in this way.

We identified ‘the importance of ingredient transparency’ and ‘the need for ingredient proof of claims’ as critical drivers of home hygiene innovation in a recent whitepaper. It’s useful to apply these factors to products with natural claims.

In the absence of an accepted legal definition for natural, the onus is on manufacturers to use the term transparently and with integrity. We suggest that a material should meet one of the following criteria to be categorised as natural:

- Ingredients directly extracted (non-chemically) or distilled from plant or animal sources and not chemically modified in any way, or

- Ingredients directly obtained via bio-fermentation (produced using micro-organisms, such as bacteria, fed and sustained with natural feedstocks, such as corn starch or sugar cane).

Materials obtained from petrochemical feedstock would not be considered natural. The same is true of natural materials that have been chemically modified, for instance:

- Ingredients obtained through the addition or subtraction of a functional group, such as an alcohol or amine group, to a natural extract, or

- Ingredients produced via chemical synthesis or modification – regardless of whether the final product is chemically identical to a substance that can also be sourced from nature.

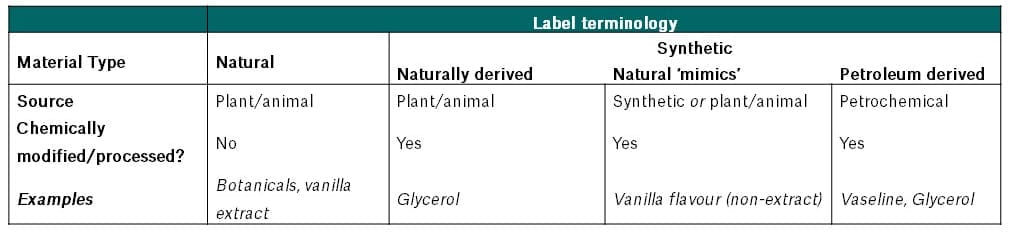

In the first non-natural scenario, the chemically modified material would be classified as ‘naturally derived’ or ‘synthetic with a natural origin’. This is especially relevant to surfactants in the home hygiene category. Traditionally obtained through chemical synthesis processes, they can also be naturally derived using natural enzymes in fermentation tanks. However, synthetic mimics of materials of natural origin cannot be described as naturally derived. For example, Madagascan vanilla extract is considered natural, but the cheaper and more easily obtainable synthetic vanilla is not. The table below summarises our recommended approach to material classification and labelling.

What’s happening in other sectors with natural labelling?

Food and beverage definitions and labelling requirements for natural ingredients indicate how the situation might develop for home hygiene. The US Food and Drug Authority (FDA) notes that a natural food product should contain no artificial or synthetic additives or ingredients (including colourants) that would not normally be expected in that food. Yet there are discrepancies between markets, especially in relation to materials produced using novel techniques. In the UK, the Food Safety Administration (FSA) considers bio-fermentation products made with natural feedstocks to be natural. This contrasts with the EU where the European Food Safety Authority (EFSA) stance remains uncertain, leading many food companies to avoid the use of bio-fermentation ingredients.

Meanwhile, with consumer interest in food and beverage products’ sustainability credentials on the up, use of the term natural is receiving more attention. While certifications for natural ingredients are available, the lack of a consistent definition means there are many grey areas.

In some cases, a product containing up to 75% natural ingredients can be certified as natural. However, this doesn’t specify whether naturally derived materials are included. So, a label claiming a product is ‘100% natural’ could have multiple meanings, which may be considered misleading. When it comes to green claims, the situation is even more complex, as natural ingredients are not necessarily more sustainable than their synthetic counterparts.

Striking an effective balance of natural formulation and labelling

Complexity surrounding the definition of natural materials is just one part of the challenge facing home hygiene product developers. Reformulating existing products, or creating new ones, to incorporate natural materials presents technical challenges that impact core properties and performance. We consider some of these in our design framework for sustainable, commercially-sound consumer packaged goods.

A top-level examination of leading home hygiene companies reveals various strategies to balance performance with the inclusion of natural ingredients. Some prioritise performance, whereas others place more emphasis on social responsibility, or position themselves as natural formulation heroes. Whatever position is taken, operating with integrity and transparency is the surest way to earn consumer loyalty and ensure regulatory compliance. Combining this with technical capabilities and insights can streamline and simplify the development of formulations with natural materials.

You can find out more about our work in the home hygiene sector here or download our whitepaper Home & Hygiene: three innovation drivers.